An Elevation Certificate is a phrase frequently

used when discussing floodplain management.

If you’ve recently heard this term and are a little confused – that’s OK! In a nutshell, if your property (either your home or your business) is in a high-risk flood zone, your insurance agent and/or carrier will more than likely require an Elevation Certificate (EC) to determine your flood insurance premium rate.

Let’s break it down.

What is an Elevation Certificate?

An elevation certificate (EC) is an important tool that documents and confirms your home’s elevation in high-risk areas relative to the estimated height floodwaters will reach in the event a major flood occurs. In addition, ECs are used by the NFIP to provide elevation information needed to:

- Determine the correct flood insurance premium cost,

- Ensure compliance with community floodplain management ordinances, or

- Support a request for a Letter of Map Amendment (LOMA) or a Letter of Map Amendment based on fill (LOMR-F)

Who Needs an Elevation Certificate?

During a 30-year mortgage, high-risk flood zone areas (Zones A and V) have a one in four chance of flooding. Because of this, an EC may be required for certain buildings in these areas if the flood insurance policy is written through a federally regulated insurance lender – for example the NFIP.

Private insurance carriers do not typically require ECs – even for high-risk flood zones. However, not every home will qualify for private coverage. Therefore, if you live or have a business in a high-risk area, it is best to obtain a copy of the EC.

ECs are not typically needed and are not used for flood zone rating in moderate- to low-risk areas (Zones B, C and X), undetermined risk areas (Zone D), or certain high-risk areas eligible for other subsidies (e.g., Zones AR and A99).

If you still have questions as to whether you need an EC, National Flood Insurance can assist with determining and providing your flood zone.

When Do You Need an

Elevation Certificate?

When you purchase a new home in a high-risk area, are looking for a better premium, or there has been a recent flood zone change in your area – a copy of your EC will more than likely be needed.

It is important to remember that in high-risk flood zones NFIP policies cannot be written without the EC for the home or building and, though most private carriers may not require an EC to issue a policy, not every home will qualify for private coverage.

Therefore, when you contact National Flood Insurance (or any other agent) to purchase your flood insurance policy and you live in a high-risk area, having a copy of your EC is best.

However, keep in mind…

If you make significant changes to your home and are in a high-risk area – for example, you convert the garage into added living space – you will likely need a new EC to reflect the new property features and lowest floor elevation.

As long as the structure information on your EC is correct, you do not need a new EC. If you obtain an EC from the previous property owner or have a copy of the one on file with your community, your insurance agent can use that EC to rate your policy.

If your community adopted new Flood Insurance Rate Maps (FIRMs) and your property has not changed, your insurance agent can still rate your flood insurance policy using the information on the old EC and the FIRM. However, you may still need to provide further information, such as updated photographs of your home or business, if needed.

Where to Get a Copy of

Your Elevation Certificate?

There are a couple of ways to obtain a copy of your EC, including:

-

Sellers of the Home.

When buying a new home, request that the sellers provide a copy of the EC – especially if the home is in a high-risk zone. If they don’t have an EC, ask if they can provide one before closing on the home.

-

Floodplain Managers.

Every NFIP participating community has a floodplain manager and an EC might already be on file.

-

Developer or Builder.

In a high-risk area, the developer or builder of the community might have been required to obtain an EC at the time they built the building or home.

-

Property Deed.

Occasionally the EC is included.

-

Hire a licensed land surveyor, professional engineer, or certified architect.

The land surveyors’ duty is to determine the elevation around the building areas on the property and certify whether or not the area in question is under or above the prescribed flood elevation. Often times there is a fee when hiring these professionals to complete an EC for you. However, before you hire one, ensure they are authorized by law to certify elevation data.

Why and How is Your

Elevation Certificate Used?

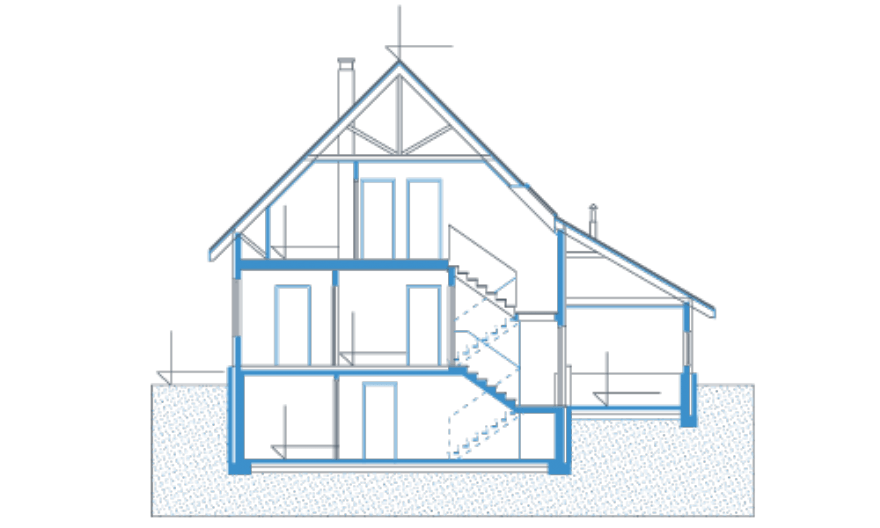

If your building is in a high-risk area (Zones A or V), the EC includes important information that is needed for determining a risk-based premium for a flood insurance policy. For example, the EC shows the location of the building, lowest floor elevation, building characteristics, and flood zone.

Your insurance agent will use the EC to compare your building’s elevation to the Base Flood Elevation (BFE). The BFE is the elevation that floodwaters are estimated to have a one percent chance of reaching or exceeding in any given year. The higher your lowest floor is above the BFE, the lower the risk of flooding. Lower risk typically means lower flood insurance premiums.

Other Useful Flood Insurance Terms:

-

Base Flood (BF):

A flood having a 1% chance of being equal to or having

exceeded in any given year. -

Base Flood Elevation (BFE):

The water surface elevation, expressed as an elevation above sea level, of the base flood. BFE is the minimum elevation a community must assume for building standards.

-

Flood Insurance Rate Map (FIRM):

A map provided by the Federal Emergency Management Agency (FEMA) displaying flood hazard areas, BFEs, and risk premium zones.

-

Pre-FIRM:

Buildings/homes constructed before the community’s first FIRM. Communities might not have Elevation Certificate information on file for these properties.

-

Post-FIRM:

A building/home constructed on or after the date of the initial FIRM for the community.

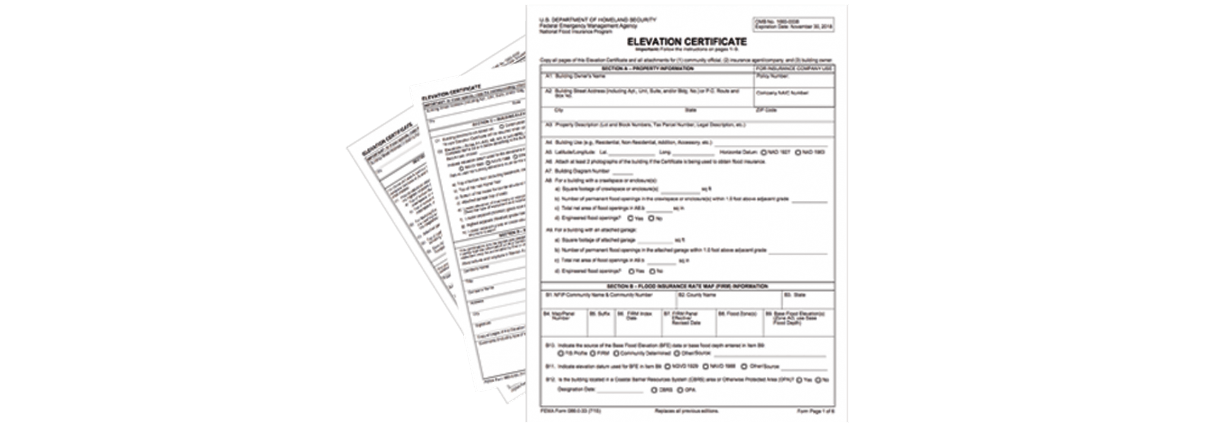

Sample Elevation Certificate

Take a look at a sample flood elevation certificate and some of the information National Flood Insurance

Click Here for a Full Screen Preview>>

Still Have a Question About Your Elevation Certificate?

Contact Us Today

Have the Elevation Certificate Information You Were Looking For?

Ready for a Free Flood Quote for Your Property or Business?